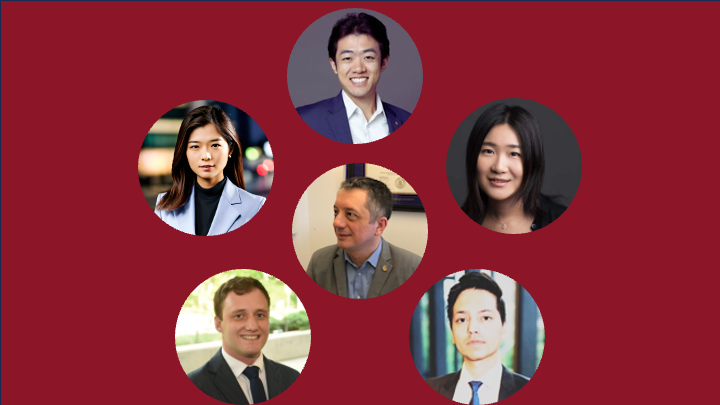

Five New Associates and Analysts Join Backer North Investments Team

Backer North Investments is excited to announce the expansion of our investment management team with five new associates and analysts. This growth enables us to intensify our focus on acquiring at least four Canadian mid-market businesses in 2024-25. Our enhanced team is a blend of diverse and dynamic professionals, each bringing unique expertise and perspective.

With a rich background in senior leadership roles, entrepreneurial experience, finance, and investments, V. L. "Vlaad" Gajic, our Founder and Managing Partner, leads the team. Wenqi Yue, our Senior Associate, contributes extensive knowledge in the healthcare and energy sectors. Associates Evan Wang, Jessie Zhao, Guilherme Pamplona, and analyst Mikael Waraich add depth with their expertise in engineering, economic consulting, finance, and logistics.

Our advisory board includes Mario Nigro, a prominent figure in Canadian mid-market M&A, and Veljko Vidovic, a relentlessly sought-after Microsoft consultant throughout North America. Ivica Kostanic, Associate Professor at Florida Institute of Technology, brings academic and industry expertise in wireless communication.

With this formidable team, Backer North Investments is perfectly positioned to partner with businesses aligning with our investment criteria. We are committed to fostering growth and success in our portfolio companies, ensuring a bright future for all stakeholders.

For more details on our team, visit Backer North Investments Team.

About Backer North Investments

Backer North Investments is a small private equity firm with a big heart. We are experienced private equity investors and operators taking mid-market businesses to the next level. The firm is headquartered in Toronto, Canada, and its team members are in New York, Boston, Chicago, and Toronto. We aim to acquire at least three mid-market businesses in North America, preferably in Canada, in 2024-25.

Please get in touch with us if you know of any acquisition opportunities matching our investment criteria.